ESG IN FINANCIAL SECTOR

The financial sector is arguably one of the most important influencers in the global effort to decarbonize and reach net-zero goals. Financial institutions can accelerate the growth of ESG-aligned companies and start-ups through their products and services. Two related perspectives are important to consider: (1) the effects of financing ESG-competitive businesses, projects and start-ups; and (2) the risks of investing in emissions-intensive industries that remain essential to the global economy. In what ways does the industry shape and create positive changes: transparency for stakeholders, managing climate risk, risks associated with policies, and funding new projects or businesses that aim to transition or aid in transitioning to net-zero.

The financial sector is a sea of vast products and reach. It is intertwined inexplicably with the global economy and based as the backbone of driving change. Let's first look at the players that need to report on their emission activities, emissions portfolio and their transition plan. It's essential to note that the SBTi identifies that any entity that earns revenues of more than 5% generated from commercial financial activities shall report on their carbon emissions (SBTi, 2020). These entities include public and private financial companies such as banks, investment banks, private equity firms, asset management companies, insurance and re-insurance companies, public pension funds, and sovereign wealth funds, amongst others.

From the historical perspective we evolve based on needs, environmental influences and curiosity. In this way, as we shift our thinking from the perspective of taking from the environment and abusing resources - to working for the environment and with it - we can drive meaningful change using a holistic thinking approach. To drive such change the world of finance needs to function as such to promote ESG initiatives. Given the complexity of financial products and the vast amount of information available from different governing and non-governing bodies - we will separate the industry and evaluate the basic ESG needs within specific institutions.

Jump to section:

REGULATORY LANDSCAPE

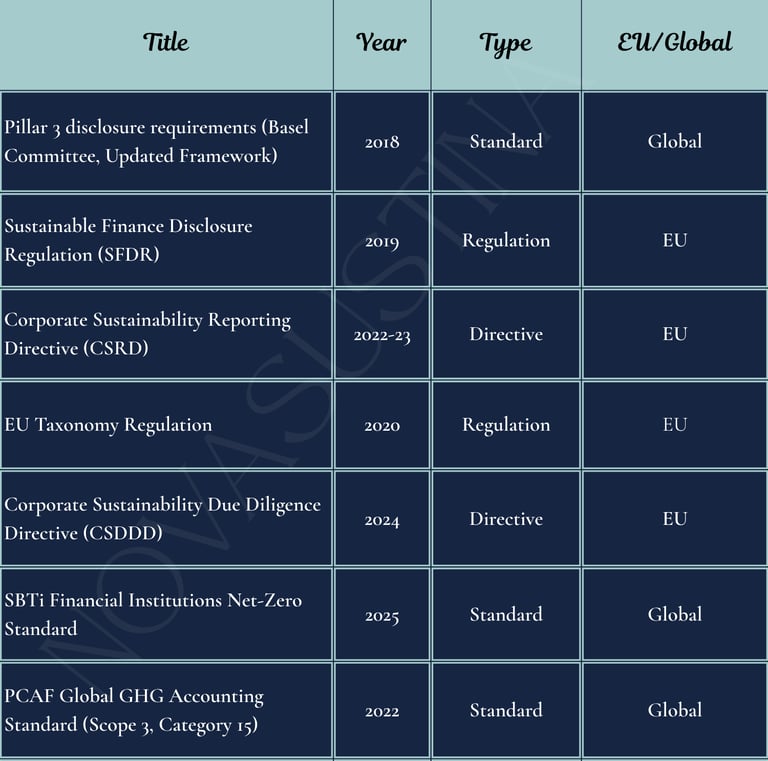

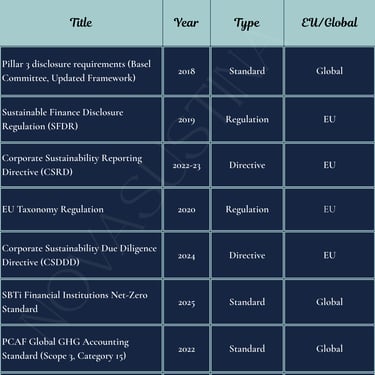

Reporting Landscape is guided by multiple standards and frameworks or guidelines. The following table shows the various standards and frameworks in use in EU and Globally.

Other notable standards that may be applicable include the GRI Standards, IFRS S1 and S2, TCFD, TNFD for nature related disclosures, and UN Principles for Responsible Banking.

Digital Tagging - (EFRAG) has developed an XBRL (eXtensible Business Reporting Language) taxonomy aligned with the European Sustainability Reporting Standards (ESRS)

ESG IN THE BANKING SECTOR

Banks and other Credit Institutions like Microfinance need to report on their lending/investing activities, green finance products, project finance, risk management, corporate operations, governance practices, social and community impact, supply chain practices and regulatory compliance. Their ability to transition to clean energy and climate friendly practices is one to be assessed.

Risk Management and Governance: includes prevention measures of money laundering (AML) and financing of terrorism (FT) risk, security governance, political Influence where there is disclosure of activities and commitments including their lobbying activities, the management and quality of relationships with customers, suppliers, and communities, payment practices, and internal code of conduct describing rules and principles to be followed throughout the company and its subsidiaries, and its business partners.

ESG Risk Integration: inclusion of environmental, social, and governance (ESG) risks and sustainability Incentives. Environmental and Social Management System (ESMS) are required to establish and maintain a framework that is supported by management.

Disclosures on loans and remuneration: includes loans to members of the management body and their related parties, disclosure on the remuneration policy and practices, and disclosure regarding incentive schemes linked to sustainability matters which are offered to members of the administrative, management, and supervisory bodies.

Climate Transition Plan: Institutions must adopt and put into effect a transition plan for climate change mitigation which aims to ensure that their business model and strategy are compatible with the transition to a sustainable economy.

Due Diligence Policy: includes across the supply chain and internally.

SFDR/Taxonomy Good Governance: should include investments that qualify as environmentally sustainable under the Taxonomy Regulation which ensure adherence to the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights. Sustainable investments under SFDR must ensure that the investee company follows good governance practices.

Environmental Metrics

EU Taxonomy Alignment: Credit institutions must disclose the proportion of their business activities that are associated with economic activities that qualify as environmentally sustainable (complies with minimum requirements related to social and governance factors).

Fossil Fuel Transition Policy: Banks (financial institutions) must publish a policy addressing new financial activities in the fossil fuel sector. This policy requires a commitment to end new applicable financial activities provided to projects and companies involved in new coal mines, extensions or expansion of existing coal mines, and new unabated coal-fired power plants immediately. It also requires immediate cessation of new project finance for new upstream oil and gas projects and new liquefied natural gas (LNG) infrastructure.

Deforestation Exposure: Banks shall commit to assess and publish their deforestation exposure by 2030 at the latest. If exposure is significant, they must publish an engagement plan to address deforestation in their portfolios.

Scope 1, Scope 2 and Scope 3 Emissions: Banks shall measure and report their operational Scope 1 (direct) and Scope 2 (purchased energy) emissions. For banks whose revenue is 95% or more from financial activities, targets must be set for Scope 1 and 2 operational emissions in line with the SBTi Corporate Net-Zero Standard. Scope 3 Emissions (Financed Emissions): The vast majority of a bank’s climate impact is accounted for under Scope 3, Category 15 of loans and investments (by asset class, by industry and by region). Gross Portfolio Emissions: When calculating the GHG emissions inventory, banks must include at minimum the Scope 1 and Scope 2 emissions of all portfolio counterparties. When calculating financed emissions, banks must adhere to a phased-in approach for including clients' Scope 3 emissions. Client Scope 3 emissions must be reported separately from client Scope 1 and 2 emissions to make potential double counting transparent.

Social Metrics

Governance Metrics

Social factors are applicable in the institutions and their affiliates as well as the institutions they finance.

Working Conditions: Requirements adhered to include secure employment, working time, fair wages, amongst others.

DEI, Equal Treatment and Opportunities: Includes gender equality and inclusion, equal pay, training and skills development (including the breakdown of workers participating in training and their demographics), employment and inclusion of people with disabilities and diverse backgrounds.

Due diligence on human rights: Addressing respect for human rights and fundamental freedoms. The information should cover the impacts of the undertaking on people, including workers, and on human health. Specifically, reporting must include information about forced labour and child labour in the value chains where relevant.

Stakeholder Engagement: includes employees and workers’ representatives (if applicable), community health, safety, and security surrounding business operations, attention to vulnerable groups example acquiring Free, Prior, and Informed Consent (FPIC) when dealing with indigenous peoples, and protecting cultural heritage.

Choice of exposure to certain industries/companies: this includes companies involved in controversial matters, or companies engaged in industries such as non-renewable energy, tobacco, controversial weapons, arctic drilling, amongst other industries.

ESG IN THE INVESTMENT BANKING SECTOR

Emissions Measurement: For CMA, the financial exposure metric is the Amount Issued. Financial institutions must measure and disclose absolute financed emissions (Scope 1 and 2, plus relevant Scope 3 emissions for specific high-impact sectors).

Sectoral Focus: The SBTi requires segmentation of CMA activities into groups based on emissions intensity, with fossil fuels (Coal, Oil, Gas) in Segment A and other Emissions-Intensive Sectors (like Transport, Steel, Cement, Energy, and Forest, Land, and Agriculture) in Segment B. Investment banks must publish policies committing to cease new finance for fossil fuel expansion.

Green/Clean Exposure: Investment banks must assess and disclose their financial exposure to clean energy relative to fossil fuels (Clean Energy-to-Fossil Fuel Financial Exposure) in terms of both absolute amounts and the ratio.

Environmental Metrics

Social Metrics

Similar to banks.

Governance Metrics

Governance Metrics are similar to banks but the Investment Firms Directive (IFD) and the Investment Firms Regulation (IFR)caters for protocol that should be followed by mid and smaller sized investment firms (class 2 and 3) as larger investment banks (class 1) already fall under traditional banking regulations.

IFD/IFR Requirements: The prudential framework for investment firms (IFD/IFR) mandates that Class 2 investment firms maintain sound governance arrangements and comply with remuneration requirements. The EBA is specifically mandated to develop comprehensive Implementing Technical Standards (ITS) on disclosure for investment firms, covering risk management objectives and policies, remuneration policy and practices, investment policy, own fund and capital requirements and ESG-related risks.

ESG IN THE INSURANCE INDUSTRY

Key Areas of Consideration:

The insurance industry faces unique ESG considerations due to its dual role in the financial ecosystem — acting both as an Asset Owner (investing premiums and reserves) and as a Risk Carrier (through insurance underwriting). This duality influences how insurers measure, disclose, and manage environmental and social risks.

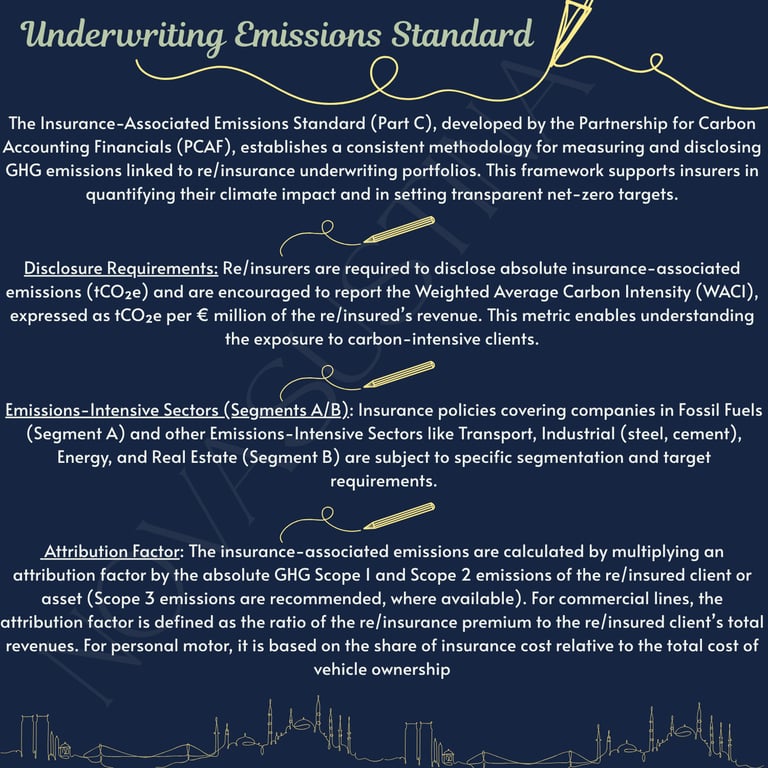

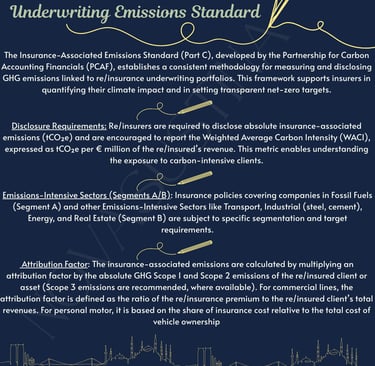

"Follow the Risk" Principle: Unlike banks or investors, insurers typically do not have ownership or direct control over insured assets or activities. The Partnership for Carbon Accounting Financials (PCAF) therefore applies the “follow the risk” principle, rather than the “follow the money” principle used for financed emissions (PCAF, 2024). This means that GHG emissions are attributed to the insurer based on the insured entity’s or asset’s underlying risk exposure, reflecting the transfer of risk to the re/insurance industry rather than capital investment.

Greenwashing Supervision: The European Insurance and Occupational Pensions Authority (EIOPA) specifically focuses on greenwashing in the insurance and pensions sector. EIOPA has issued principles requiring that sustainability claims made by insurance providers be accurate, precise, consistent, substantiated, updated, and accessible (EIOPA, 2024).

Principal Adverse Impacts (PAIs): Insurance-Based Investment Products (IBIPs) are financial products defined under the SFDR. Insurers providing insurance advice or products (including IBIPs) must disclose information on the consideration of adverse sustainability impacts covering social and human rights matters, anti-corruption, and anti-bribery, and then outlining how these impacts are considered in product design, advice, and investment strategies.

Climate Risk Assessment and Scenario Analysis: Insurers are increasingly expected to conduct climate scenario analyses and stress testing in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. These exercises evaluate both physical risks (e.g., extreme weather events) and transition risks (e.g., regulatory and market shifts toward decarbonization) (TCFD, 2017).

Product Innovation and Social Inclusion: ESG also encompasses social and inclusive insurance expanding access to coverage for vulnerable or underserved populations and developing products that support climate adaptation, resilience, and sustainable infrastructure.

Source: Partnership for Carbon Accounting Financials (PCAF). Insurance-Associated Emissions: Standard for Measuring Financed and Facilitated Emissions – Part C (Insurance-Associated Emissions). Version 1.0. Amsterdam, 2024. Available at: https://carbonaccountingfinancials.com/insurance-associated-emissions

Digital Tagging - this process implemented by EFRAG refers to the coding certain information in reports using standardised machine-readable tags based on a digital taxonomy. (EFRAG) has developed an XBRL (eXtensible Business Reporting Language) taxonomy aligned with the European Sustainability Reporting Standards (ESRS)

• In-Scope Bank Asset Classes: The PCAF Standard covers Listed equity and corporate bonds, Business loans and unlisted equity, Project finance, Commercial real estate, Mortgages, and Motor vehicle loans.

• Attribution Principle ("Following the Money"): The attribution factor is calculated by dividing the outstanding amount of the loan/investment by the total value of the borrower or investee. For listed companies, the denominator used is the Enterprise Value Including Cash (EVIC); for private companies, it is the sum of total equity plus debt. This approach ensures emissions are fully attributed across all providers of equity and debt, minimizing double counting between cofinancing institutions.

DEFINITIONS

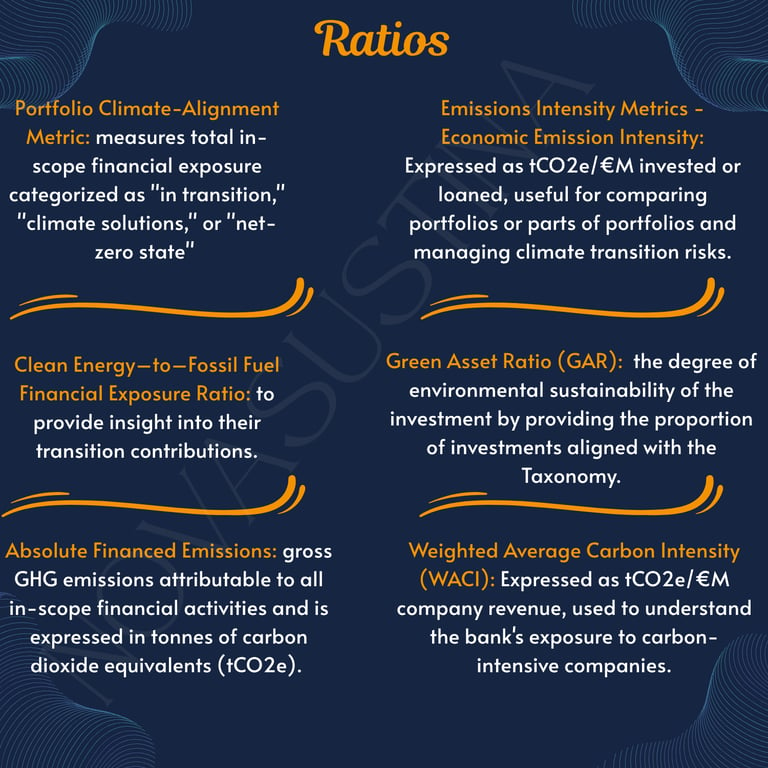

Understanding different metrics:

Absolute emissions: Total GHG emissions of an asset class or a portfolio.

Economic emissions intensity: used to compare emission intensity of different portfolios.

Physical emissions intensity: compares emission intensity of a common output within companies in the same sector.

Weighted Average Carbon Intensity: evaluates a portfolios exposure to carbon-intensive companies.

Source: The Global GHG Accounting and Reporting Standard for the Financial Industry page 23.

Sources

Basel Committee on Banking Supervision (BCBS) (2017) - Basel III: Finalising post-crisis reforms.

Commission Delegated Regulation (EU) 2022/1288 of 6 April 2022 supplementing Regulation (EU) 2019/2088... (SFDR Regulatory Technical Standards/CDR 2022/1288).

Directive (EU) 2022/2464 regarded as corporate sustainability reporting (CSRD).

Directive (EU) 2024/1760 of the European Parliament and of the Council of 13 June 2024 on corporate sustainability due diligence (CSDDD)

EBA Roadmap for the new Market and Counterparty Credit Risk approaches (2019)

European Insurance and Occupational Pensions Authority (EIOPA). Supervisory Statement on Sustainability Claims and Greenwashing in the Insurance and Pensions Sector. 2024.

GHG Protocol (2004): The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (Revised Edition). World Resources Institute and World Business Council for Sustainable Development.

IFC Performance Standards (2012).

Partnership for Carbon Accounting Financials (PCAF). (2020). The Global GHG Accounting and Reporting Standard for the Financial Industry.

Partnership for Carbon Accounting Financials (PCAF). Insurance-Associated Emissions: Standard for Measuring Financed and Facilitated Emissions – Part C (Insurance-Associated Emissions). Version 1.0. Amsterdam, 2024.

Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (SFDR).

Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment (Taxonomy Regulation).

Science Based Targets initiative (SBTi) (2020). Financial Sector Science-Based Targets Guidance

Science Based Targets initiative (SBTi) (2021). SBTi Corporate Net-Zero Standard

Task Force on Climate-related Financial Disclosures (TCFD). Final Recommendations Report. Financial Stability Board, 2017.

Disclosure

This website does not send email alerts, newsletters, or unsolicited subscription requests. All contact is initiated through the contact form, which enables direct communication via personal email for those who wish to engage further.

All users are encouraged to read our Terms and Conditions